This story was written by Cori Burcham

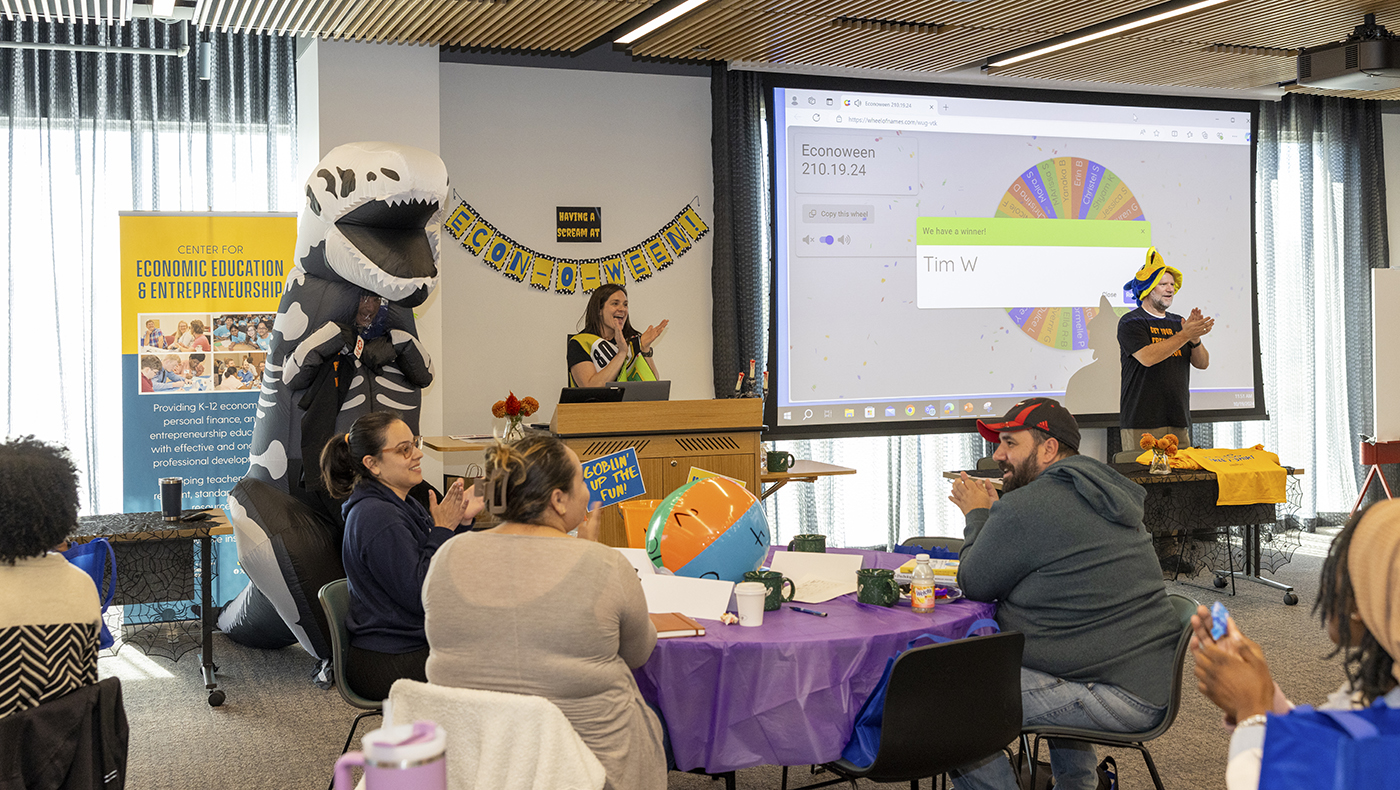

The University of Delaware’s Center for Economic Education and Entrepreneurship (CEEE) in the Alfred Lerner College of Business and Economics recently hosted its second annual Econ-O-Ween Fall Mini Conference, which demonstrated to local K-12 teachers that discussing complex economics and personal finance concepts with their students isn’t as scary as it may seem. The series of workshops held at the FinTech Innovation Hub in mid-October, organized in celebration of Economics Education month, gave educators resources for the classroom to help them address topics from the risks of fraud to the uncomfortable world of improv, befitting of the spooky season.

Launched last fall as an abbreviated version of UD’s CEEE Economic Education Conference, Econ-O-Ween was developed to continue providing local educators with professional learning opportunities during the school year to support the teaching of economics and personal finance within the elementary, middle, and high school curriculum. Unlike the summer conference, which divides the presentations into concurrent sessions organized by grade level, the fall format features a 20-minute session by CEEE Instructional Designer Amy Krzyzanowski and three 40-minute sessions from outside experts geared toward educators of varying grade levels.

“The guest speakers at Econ-O-Ween are a combination of industry experts and classroom teachers, which allows our teacher audience to hear about current economic trends while also receiving practical, classroom-tested ideas from their peers,” said Krzyzanowski. “The agenda is carefully planned to ensure teachers of all grade levels walk away with actionable strategies and resources for teaching economics that can be taken back for immediate use in their classrooms.”

Educators enjoyed a complimentary breakfast sponsored by Robinhood via the Delaware Council on Economics Education and had the opportunity to network with fellow teachers prior to the presentations. Each educator was also provided with two personal finance books and a gift card thanks to the generous support of YourMoney101.org. Jon Bell from the Better Business Bureau kickstarted the conference with the first session of the day, “Red Flags of Fraud.” Over the course of his decade-long experience in fraud and scam outreach, Bell’s learned that providing younger consumers with basic education on financial literacy could prevent them from becoming a victim of fraud in the future, especially since 15% of fraud reports indicate people under the age of 19 are losing money.

“What we found in partnership with organizations like FINRA and other national partners is that the tricks [scammers] are using are able to be taught. Why protect you against one particular scam if I can show you the strategies that are applied to tomorrow and the day after’s scams as well?” said Bell. Detailing a list of the five most common tactics scammers use to leverage social engineering, Bell had educators play a game that doubles as a resource for the classroom. Providing examples of fraudulent phishing messages, Bell had participants spot the strategy being implemented in each example to better identify the red flags of fraud in their daily life.

Marissa Snyder, a third-grade teacher at Kathleen H. Wilbur Elementary, found Bell’s presentation particularly relevant to her own classroom when he noted that legitimate businesses such as Prodigy Math — an interactive math-practice game Snyder’s students frequently play — uses the same psychological tricks to encourage its players to subscribe to their program. She intends to pass along this information to her students as a pertinent reference for them to better understand Bell’s teachings.

The second session of the day led by Michael Scerbo, a former principal consultant at Longford Credit Ratings Advisors and UD graduate, gave an overview of corporate credit ratings and detailed how the three major agencies — S&P Global, Fitch Ratings, and Moody’s Investors Service — determine an entity’s rating based on financial performance factors. To translate the complex subject to high school level students, Scerbo provided a lesson plan that involved analyzing a chart of fiscal data from real corporations and matching the S&P Global ratings to each one. This useful tool gave teachers of upper school students a rudimentary understanding of an industry Scerbo notes is often overlooked in the curriculum.

Staci Garber, a Master of Arts in Economics and Entrepreneurship for Educators (MAEEE) alum and teacher at Kirk Middle School, led an interactive session about the benefits of practicing improvisational comedy in an economics classroom. “In order to have quality civil dialogue, students need to feel comfortable to express themselves openly, make mistakes, make new and different choices, and accept a whole lot of discomfort,” said Garber, noting that moments of temporary failure and embarrassment in improv helps students open up by normalizing their mistakes. After instructing the attendees to form two separate circles, Garber demonstrated a few warm-up exercises she’s previously tested in her middle school classrooms to develop communication and debate skills:

- Pass the Clap, an exercise that asks students to turn to the person next to them, clap in unison, and continue to pass it around the circle, teaches students that active listening engages the entire body, especially through eye contact.

- Mirroring, a one-on-one challenge that has a pair of students face each other and mirror their movements to learn to communicate without speaking and build trust with their partner.

- Yes Circle, a similar exercise to Pass the Clap in which participants say “yes” around the circle and can change its direction by responding “no,” depersonalizes disagreement and encourages students to be more open minded during civil dialogue.

In addition to these exercises, Garber also shared some performance games — Plan a Party, Hike the Gesture, and Period, a game invented by her own middle schoolers — that has students collaborate together and build off of an initial action. Implementing any of these exercises before civil dialogue provides students with the tools to learn to cooperate and trust one another, resulting in more effective discussions and better learning opportunities.

During the final presentation “Financial Literacy Lessons Related to Risk,” Krzyzanowski joked that elementary school teachers likely won’t be discussing some of the more advanced topics, such as corporate credit ratings, with their little learners. To ensure educators still had a way to impart the four required financial literacy standards, which begin in kindergarten and broaden in complexity into upper school, each teacher was provided with a folder of lesson plans specific to their grade level on the concept of risk. Krzyzanowski showcased how the fourth standard “risk protection” can be accessible to younger learners through a few activities, including a lesson on risk that has students vote with their hand which action out of two options is more dangerous.

After the lectures, the magical day of learning ended with a visit from the financial literacy mascot, an inflatable skeleton dinosaur, who raffled off CEEE t-shirts featuring fun economics-themed sayings. The priority of the CEEE to accommodate teachers also extends to providing flexible programming by offering the conference on a Saturday morning, a risky venture Krzyzanowski notes that received an overwhelmingly positive response.

“The CEEE remains dedicated to meeting the evolving needs of Delaware educators through flexible programming,” said Carlos Asarta, CEEE’s James B. O’Neil Director. “In-school professional development, Econ-O-Ween and our Personal Finance and Economic Education Conference, or other professional learning opportunities are always designed with educators and their schedules in mind. We are here to support them so that, one day, we may see all students graduate as informed and productive citizens contributing to their own prosperity and to the well-being of the world.”